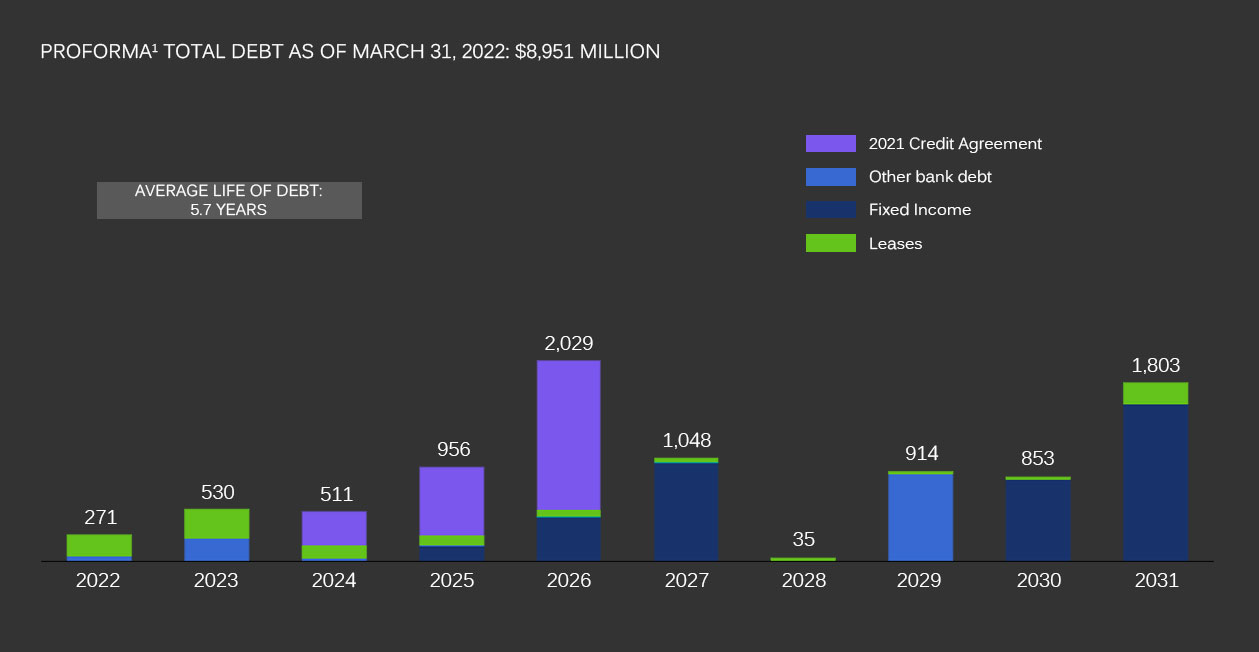

Maturity Profile

Debt Information

Discover more about our publicly traded debt instruments and debt profile.

Maturity Profile

Information as of March 31, 2022

Debt maturity profile as of March 31, 2022 (Proforma)

Millions of U.S. dollars

1) Giving proforma effect to the purchase of $438.8 M aggregate principal amount of the following Notes: $167.9 principal amount of the 5.20% Notes due 2030, $111.6 M principal amount of the 5.45% Notes due 2029, and $159.3 M principal amount of the 3.875% Notes due 2031, that were validly tendered by holders of the Notes during the tender offer dated March 28, 2022 and early settled on April 13, 2022 and finally settled on April 27. Additionally, reflects a drawdown of $426 M of our Revolving Credit Facility to fund the purchase of these bonds.

-

Key Company FAQs

If you have any questions regarding investing with CEMEX, this is the place.

Company FAQs -

Glossary

An alphabetic list of terms and definitions specific to financial and industry topics.

Glossary